Display Glass Revenue Hits Record JPY 270 Billion in Q3 2025, Driven by Price Increases and Robust Demand, Omdia Reports

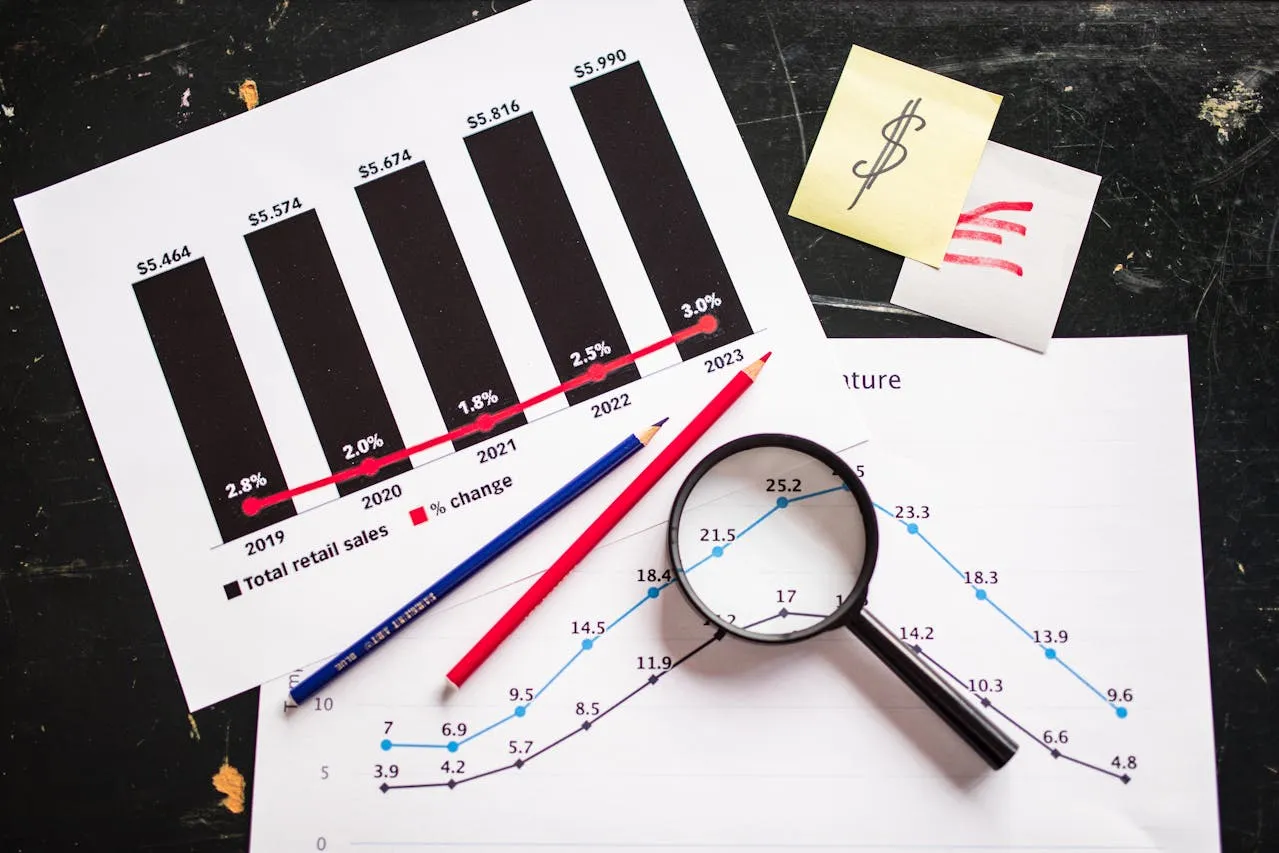

Display glass revenue reached an unprecedented high of JPY 270 billion in the third quarter of 2025, marking a significant milestone for the global display materials industry, according to recent research from Omdia. This represents a 5% increase compared to the previous quarter and a 14% rise compared to the same period in 2024, highlighting strong market momentum. Notably, the display glass market continues to be predominantly traded in Japanese yen, reflecting the strong presence of Japanese manufacturers in the sector.

The surge in revenue is largely attributed to two key factors: rising prices and growing demand for display glass across multiple applications. The increase in prices reflects a strategic transformation within the industry, which has shifted its focus from aggressive market share expansion to profitability. This pivot marks a significant change after years of price wars and thin margins that characterized the period following the global recession of 2011.

From 2012 to 2022, the display glass market faced a decade-long period of intense competition. Major glass manufacturers frequently lowered prices to secure orders from panel makers, in some cases even absorbing losses. This approach, while helping to capture market share, suppressed profitability and limited investment in new technologies. However, since 2022, a strategic shift has taken hold. Manufacturers have prioritized sustainable profits over sheer volume, adopting pricing strategies aimed at strengthening financial performance rather than engaging in unprofitable competitive practices.

Corning, a leading U.S.-based glass maker, spearheaded this trend in the second half of 2023 by implementing price increases across multiple product lines. This move was followed in the second half of 2024 by coordinated price hikes from Corning and Japan-based AGC, with NEG also contributing to the pricing strategy. As a result of these initiatives, display glass prices have climbed more than 25% over the past two years. This pricing discipline has been a key driver of the record revenue seen in Q3 2025, demonstrating that strategic focus on profitability can yield tangible results even in a highly competitive market.

In addition to price management, major display glass manufacturers have also adjusted their production strategies. Historically, companies maintained excess production capacity to meet anticipated demand, a practice that contributed to oversupply and pressured margins. Glass production is a capital-intensive process; even minor incidents in production, such as equipment malfunctions or raw material issues, can require months to fully recover a glass tank’s output. Consequently, manufacturers are now carefully managing production capacity to align more closely with actual shipments. Rather than investing heavily in new glass tanks, companies are focusing on optimizing existing facilities through measures such as increasing line speeds, improving production yields, and enhancing energy efficiency.

This careful capacity management contrasts sharply with the approach of many Chinese display glass manufacturers. Since entering the display glass market around 2010 with G5 glass production, Chinese companies have rapidly expanded their presence and now hold a dominant share of the G5 a-Si glass market. Today, these manufacturers are aggressively investing in larger G8.5 glass tanks, signaling their intent to capture a larger share of the high-end market in the coming years. While Japanese and U.S. manufacturers currently maintain a quality advantage, Chinese players are expected to close this gap over the long term. As these companies refine their processes and scale up production, they are likely to increase their G8.5 market share significantly within the next five to ten years.

This dynamic suggests a dual strategy among major global glass makers: maximize profitability in the near term while investing in future growth opportunities. According to Tadashi Uno, Research Manager at Omdia, “As major glass makers may face potential market share erosion, their current strategy appears to focus on generating profits today to fund investment in future business segments.” Indeed, companies are actively developing specialized glass products for emerging sectors beyond traditional display panels, including the semiconductor industry, hard disk substrates, and through glass via (TGV) applications. These new business areas promise higher margins and greater strategic value, positioning leading glass makers to capitalize on long-term growth opportunities.

The surge in display glass revenue also reflects broader trends in the global display market. With the proliferation of high-resolution monitors, large-format TVs, and mobile devices, demand for high-quality glass substrates continues to expand. Additionally, emerging applications such as augmented reality (AR), virtual reality (VR), foldable displays, and automotive screens are creating new opportunities for glass manufacturers. The combination of increasing unit demand and higher glass prices has created a favorable environment for revenue growth, allowing leading manufacturers to achieve record financial performance.

From an operational standpoint, major glass producers are leveraging technology to improve efficiency and sustainability. By enhancing line speeds and optimizing production yields, companies can extract more value from existing equipment without incurring the substantial capital costs associated with building new glass tanks. Energy efficiency initiatives also contribute to profitability while addressing growing environmental concerns, particularly as global markets increasingly demand lower carbon footprints from industrial processes. These measures ensure that manufacturers can meet rising demand while maintaining cost-effective operations.

The competitive landscape remains dynamic, with Chinese manufacturers exerting upward pressure on global supply. Aggressive capacity expansions in G8.5 glass production by Chinese firms are expected to influence market pricing and market share over the next decade. However, leading manufacturers currently retain advantages in quality, yield consistency, and technological expertise, which continue to differentiate their products in high-end applications. As these competitors scale and improve, the market may see a gradual rebalancing of share between Japanese, U.S., and Chinese producers.

Looking forward, Omdia’s research highlights that display glass manufacturers will likely continue prioritizing profitability while cautiously expanding into new markets. The combination of strategic pricing, production efficiency, and investment in specialized glass products positions major players to navigate competitive pressures and capitalize on future demand. The market’s ongoing evolution underscores the importance of adaptability, technological innovation, and careful capacity management in maintaining a leading position.

In conclusion, the record JPY 270 billion revenue achieved in Q3 2025 reflects not only the rising prices and strong demand for display glass but also a broader strategic transformation within the industry. After a decade of intense competition and margin pressures, manufacturers have successfully shifted focus toward profitability and operational efficiency. While Chinese competitors continue to expand their footprint, major global glass makers are strategically positioning themselves to generate near-term profits and invest in long-term growth through innovative applications in semiconductors, hard disk substrates, and advanced display technologies. The display glass market is evolving, and companies that balance quality, efficiency, and strategic foresight are best positioned to thrive in the coming years.

The insights and data presented in this report are based on Omdia’s latest research, which provides comprehensive market tracking, forecasts, and analysis of the global display supply chain. This research highlights key trends, competitive dynamics, and opportunities for investment, offering stakeholders a detailed understanding of the forces shaping the display glass market today and into the future.