Global Lab Automation Market Set to Reach $16 Billion by 2035

The global lab automation market is projected to grow from USD 6.5 billion in 2025 to USD 16 billion by 2035, expanding at a compound annual growth rate (CAGR) of 9.4% over the forecast period. This rapid growth reflects the increasing demand for accuracy, efficiency, and cost-effectiveness in diagnostic and research laboratories worldwide.

The Rise of Laboratory Automation

Laboratory automation, which first began to take shape in the 1950s, was developed with the primary aim of reducing human error and improving turnaround times in laboratory testing. Human error continues to account for nearly 30% to 86% of all pre-analytical mistakes in laboratory processes, making automation an effective solution to significantly reduce variability and improve reliability.

Over the years, the adoption of automation has transformed from a niche innovation to a mainstream necessity across healthcare, pharmaceutical, and biotechnology sectors. Researchers and industry players alike have recognized its ability to streamline processes, enhance quality, and reduce costs by replacing manual operations with automated systems.

Technological Advancements Fueling Growth

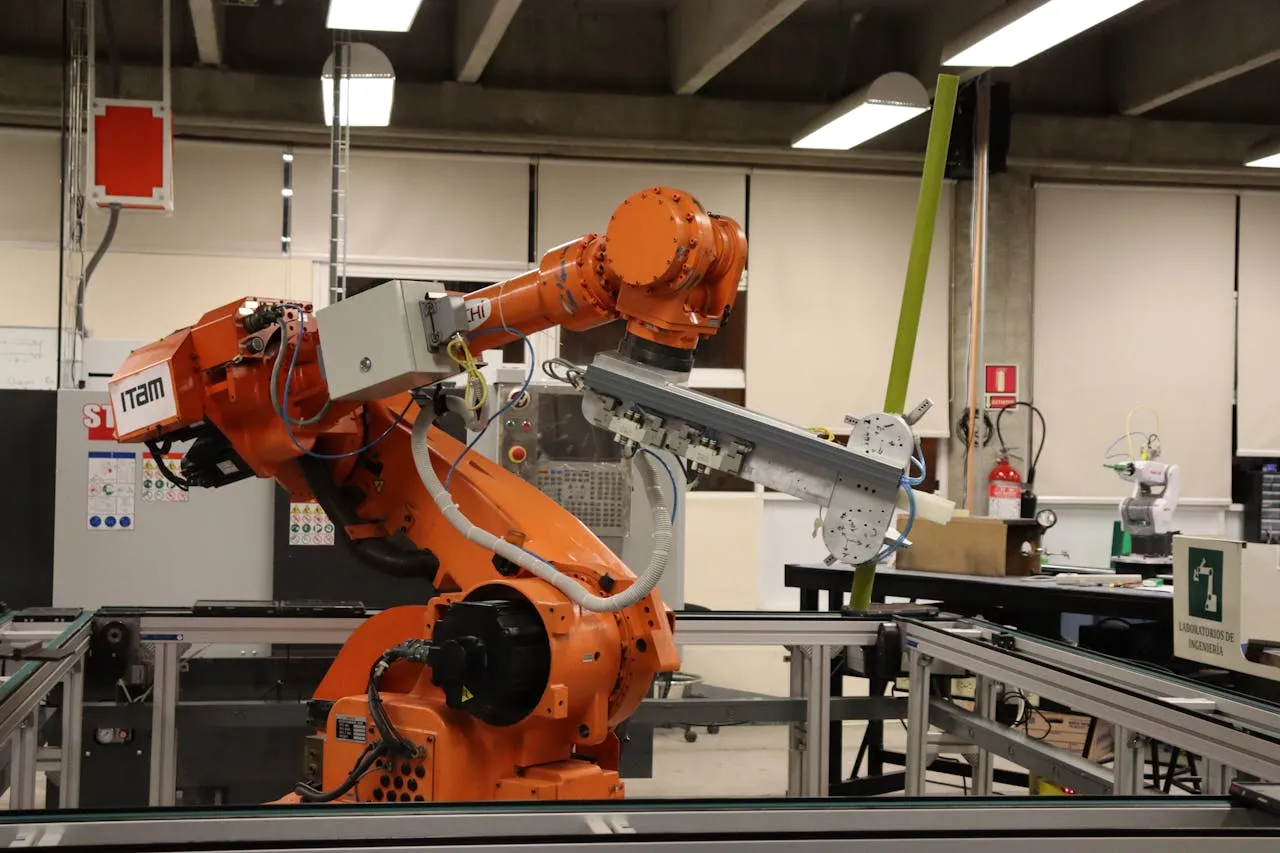

The last decade has seen groundbreaking progress in laboratory automation technologies. Modern systems are no longer confined to simple robotic arms; instead, they now incorporate advanced mobile robots, automated liquid handling systems (ALHS), and automated storage and retrieval systems (ASRS).

- Mobile robots are being developed to autonomously transport and manage laboratory materials, easing the workload of technicians and reducing inefficiencies.

- Automated liquid handling systems (ALHS) have become widely adopted because of their ability to improve sample preparation, increase throughput, and ensure consistent reproducibility.

- Automated storage and retrieval systems (ASRS) cut down variable costs by eliminating manual labor for tasks like picking, inventory management, and replenishment.

The combined impact of these advancements is expected to make lab operations faster, more scalable, and more reliable, while also freeing scientists to focus on higher-value research activities.

Market Insights and Trends

The latest report on the lab automation market highlights several critical insights:

- Pre-analytical stage dominance: Over 90% of lab automation manufacturers are focusing on pre-analytical instruments, with ALHS and automated analyzers (AAS) being the most widely adopted by pharmaceutical and biotechnology companies.

- Competitive strategies: Companies are aggressively expanding their product portfolios to maintain compliance with evolving industry benchmarks and secure a competitive edge.

- Partnership growth: Collaborative activity in the sector has grown at a 25% CAGR, with most deals signed in the last three years, underscoring the industry’s momentum.

- Innovation in IP: More than 6,200 patents related to lab automation have been filed or granted recently, signaling a surge of interest in scalable and configurable solutions.

- Regional dominance: A majority of lab automation software providers are headquartered in North America, where over 55% of the market is captured by smaller players.

- Healthcare adoption: With rising demand for automated solutions in diagnostics, pharmaceuticals, and biotechnology, software providers stand to benefit significantly.

These findings indicate that the market opportunity is expected to be well distributed across instruments, end-users, regions, and automation stages.

Key Players Driving Innovation

Several companies are playing a pivotal role in advancing lab automation. Notable names include:

- Abbott

- Anton Paar

- BD

- Beckman Coulter

- ERWEKA

- Leuze

- Ortho Clinical Diagnostics

- Pall Corporation

- PerkinElmer

- Roche Diagnostics

- Siemens Healthineers

- SYSTAG

These organizations are actively expanding their capabilities, focusing on product innovation, and investing in collaborative initiatives to strengthen their market presence.

Research Coverage and Analytical Depth

The report provides a multi-dimensional analysis of the lab automation industry, covering:

- Market sizing and opportunity analysis by stage of automation, instrument type, application, and geography.

- Competitive landscape assessment of more than 350 manufacturers, categorized by company size, headquarters location, product portfolio, and end-users served.

- Company competitiveness benchmarking to evaluate product diversity, strengths, and innovation capacity.

- Profiles of leading players highlighting financials, product pipelines, and strategic initiatives.

- Partnership and collaboration analysis, tracking deal activity, partnership models, and regional distribution.

- Patent analysis, offering insights into emerging technology areas, key assignees, and valuation benchmarks.

- Case studies focusing on lab automation software providers, deployment models, and industry applications.

Outlook and Opportunities

As laboratories worldwide continue to embrace digital transformation, automation will remain a cornerstone of operational strategy. By reducing human error, increasing reproducibility, and improving throughput, lab automation is poised to reshape healthcare diagnostics, biotechnology, and pharmaceutical research.

The projected $16 billion market size by 2035 underscores not just the growing demand for automation technologies, but also the expanding role of partnerships, patents, and innovation. Companies that can combine advanced automation systems with flexible, scalable solutions are likely to be at the forefront of this growth.

For stakeholders—whether established players, emerging entrants, or investors—the next decade represents a critical window of opportunity to capitalize on the accelerating adoption of laboratory automation worldwide.