Fortress Investment Group has announced the acquisition of Infra Pipe Solutions (“IPS”), a leading North American manufacturer of high-density polyethylene (HDPE) pipes and related infrastructure products. The acquisition was executed through funds managed by affiliates of Fortress, which now hold a majority stake in the company, while IPS’s management team retains a minority ownership interest.

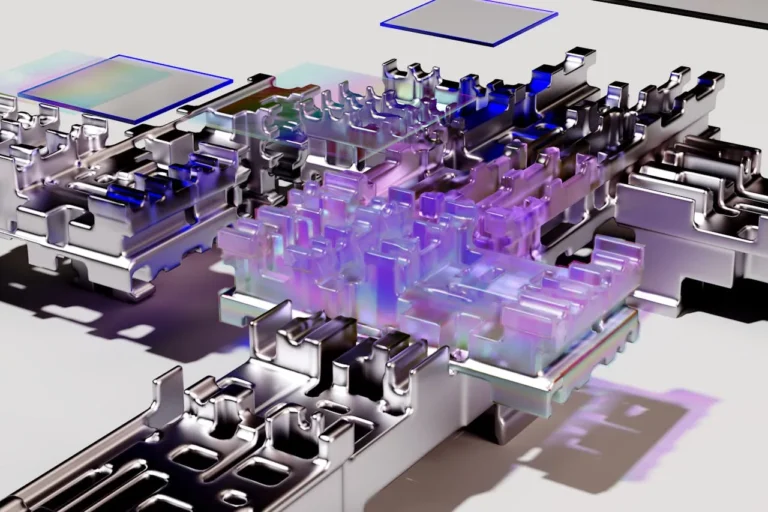

Infra Pipe Solutions, renowned for its innovative approach to HDPE pipe production, has been a key player in the industry for over five decades. The company specializes in manufacturing a wide range of HDPE products, including pipes and structures under well-established brand names such as Sclairpipe®, Weholite®, Endopure®, and Enduct®. These products are essential components in various infrastructure projects across North America, with applications spanning industries like water management, telecommunications, and clean energy.

The acquisition is set to propel IPS into a new phase of growth, with an emphasis on expanding production capacity and meeting the rising demand for HDPE pipes. “Our partnership with Fortress marks a new chapter for Infra Pipe Solutions. The investment will enable us to accelerate our growth plans and meet the increasing demand for our products, driven by the substantial infrastructure investments underway across North America,” said Bill Donaldson, CEO of Infra Pipe Solutions. He further emphasized the importance of HDPE pipes in critical infrastructure sectors, from the expansion of potable water systems and broadband networks to the growing need for data transmission and clean energy projects.

According to Donaldson, the demand for HDPE products is expected to remain robust for the coming decades, fueled by ongoing projects that rely on these materials. These include the broad expansion of water infrastructure in the United States, the continued development of broadband networks in rural areas, and the essential role of HDPE pipes in the clean energy transition, especially in the transmission of minerals and the construction of data infrastructure. “Infra Pipe Solutions is uniquely positioned to supply products that are vital to these infrastructure developments, and this new investment will help us scale operations to better serve our customers.”

Ben Green, Director at Fortress, echoed this sentiment, highlighting IPS’s strong market position in HDPE manufacturing. “We are confident that IPS is in an excellent position to benefit from the growing demand for HDPE products, with the broadest product range and the most extensive manufacturing footprint in the industry,” said Green. “The management team has developed a strong growth plan, and we are excited to work closely with them to execute that strategy and drive the company’s success.”

Infra Pipe Solutions operates a number of strategically located manufacturing facilities across North America, including plants in Saskatoon, Saskatchewan; Huntsville, Ontario; Rockaway, New Jersey; Pryor, Oklahoma; and Greeneville, Tennessee. This network gives the company a substantial geographic footprint, enabling it to serve customers across a variety of industries. IPS’s product offerings are diverse, ranging from pipes for potable water, wastewater, stormwater, and irrigation systems to natural gas distribution, geothermal vaults, pump stations, and mining applications.

The company’s extensive product range includes Sclairpipe, EndoPure, and Endopoly for pressure applications in sizes ranging from 0.5” to 63” internal diameter. IPS also manufactures Weholite structural profile wall pipe for gravity-fed and low-pressure applications, available in custom sizes up to 132” internal diameter. In addition, the company produces medium- and high-density gas distribution pipes, telecommunications conduit, and a variety of other infrastructure components.

The acquisition comes at a time when the demand for HDPE products is expected to grow significantly, driven by the urgent need for infrastructure upgrades and new construction projects. IPS’s commitment to product innovation, sustainability, and quality manufacturing positions the company to meet this demand while continuing to lead the industry.

Moelis & Company LLC served as exclusive financial advisor to Fortress, while Evercore acted as placement agent on the financing.

Through this strategic acquisition, Fortress Investment Group aims to enhance Infra Pipe Solutions’ capabilities, positioning the company for continued success in the expanding infrastructure sector. With significant investments planned for the future, IPS is poised to play a key role in meeting the evolving needs of North American infrastructure.