Faraday Future Sets March 2025 EGM to Drive Strategic Growth with Key Proposals

Faraday Future Intelligent Electric, a California-based global leader in shared intelligent electric mobility ecosystems, has announced its plans to host an Extraordinary General Meeting (EGM) of stockholders on March 7, 2025. The EGM aims to seek approval for several critical proposals designed to bolster the Company’s strategic initiatives and long-term growth. In preparation for this event, Faraday Future is urging all stockholders to vote in favor of the proposed resolutions, which include key measures aimed at supporting both immediate needs and long-term objectives.

Proposal Highlights:

- Share Authorization Proposal

Faraday Future is proposing an amendment to the Company’s Charter to increase the number of authorized shares of Common Stock by 25,000,000, raising the total from 104,245,313 to 129,245,313. This increase represents a 24% rise in the company’s authorized shares. Moreover, the total number of authorized shares, including Preferred Stock, will rise from 114,245,313 to 139,245,313. This increase is a strategic move to ensure the Company meets its obligations to holders of certain convertible notes. - Private Placements Proposal

The Company seeks approval to issue Common Stock to holders of certain convertible notes and warrants in compliance with Nasdaq Listing Rule 5635(d). This step ensures that Faraday Future remains in line with regulatory requirements while enabling the Company to meet its obligations to convertible noteholders. - Auditor Ratification Proposal

Faraday Future is also proposing the ratification of Macias Gini & O’Connell LLP (“MGO”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025.

Rationale Behind the Share Authorization Increase

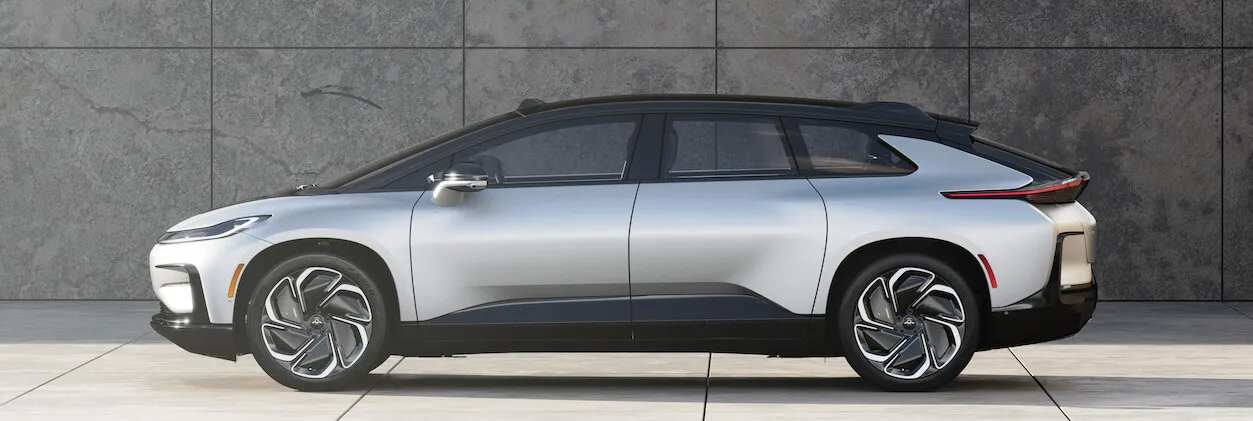

The proposed 24% increase in authorized shares is a key element of Faraday Future’s broader capital strategy. The increase is primarily designed to fulfill contractual obligations to holders of the Company’s convertible notes, including those arising from a recently announced $30 million convertible note financing. These funds have been instrumental in advancing Faraday Future’s flagship Faraday X (“FX”) strategy and supporting the continued delivery of the FF 91 2.0 model.

Faraday Future views this increase as an essential step toward securing additional resources to support the development of the FX mass-market strategy. This initiative represents a significant expansion of the Company’s addressable market, aimed at making intelligent electric mobility more accessible to a broader consumer base. Furthermore, the increased share authorization will support the ongoing production and delivery of the FF 91 2.0, which remains a cornerstone of the company’s premium vehicle lineup.

Strategic Growth and Managing Stockholder Concerns

Faraday Future is keenly aware of stockholder concerns regarding dilution and the potential for increased stock volatility. In response, the Company has worked diligently to ensure that any increase in authorized shares is done with a measured and cautious approach, balancing the Company’s immediate capital needs with the long-term interests of stockholders. The funds generated from the issuance of additional shares will play a crucial role in strengthening the company’s liquidity, supporting the FX brand’s growth, and ensuring the successful execution of Faraday Future’s long-term vision.

A key part of the Company’s efforts to maintain stockholder confidence is its commitment to meeting Nasdaq’s continued listing standards. Faraday Future is focused on ensuring compliance with all relevant rules, including the minimum bid price rule. As long as the Company’s stock price remains above the $1.00 threshold, no further actions will be required to maintain compliance with Nasdaq. However, if necessary, Faraday Future will consider a reverse stock split as a last-resort measure.

In addition, Faraday Future continues to monitor and address potential instances of illegal short-selling, which has historically been a concern for the Company. The Company remains committed to investigating any suspicions of such activity thoroughly and taking appropriate action when necessary.

Reinforcing Long-Term Growth and Building Investor Confidence

The increase in authorized shares is not only a response to immediate needs but also part of a broader long-term strategy aimed at fostering sustainable growth. Faraday Future is focused on adopting a healthier capital structure, one that supports cost optimization, operational efficiency, and the successful execution of its dual-brand strategy. The Company’s leadership believes that the strategic use of remaining financings—particularly the $20 million in gross financing currently available—will be crucial in ensuring operational efficiency and the successful rollout of the FX strategy.

This shift toward a stronger and more effective business strategy has already led to renewed engagement with top-tier investment banks, suppliers, and original equipment manufacturer (OEM) partners. Furthermore, the Company continues to engage with potential strategic investors, including those from the Middle East, signaling a strong outlook for future capital partnerships and strategic collaborations.

As Matthias Aydt, Faraday Future’s Global Chief Executive Officer, explains, “These proposals, particularly the increase in authorized shares, are critical to executing our dual-brand strategy. The successful completion of our recent $30 million financings demonstrates investor confidence in our vision. The additional authorized shares will help ensure we can continue to execute both our premium FF 91 program and our exciting new FX mass-market initiative.”

Details of the Extraordinary General Meeting

The EGM is scheduled to take place on March 7, 2025, at 12:00 p.m. Eastern Time. The meeting will be held virtually, and stockholders can participate by visiting the following link: http://www.virtualshareholdermeeting.com/FFIE2025SM. Stockholders of record as of January 28, 2025, are eligible to vote on the proposals during the meeting.

Faraday Future’s leadership is optimistic that the proposed resolutions will be approved by stockholders, paving the way for the continued success of the Company’s strategic initiatives. As the electric mobility landscape continues to evolve, Faraday Future remains committed to shaping the future of transportation through innovation and sustainable growth.