ASTRONOVA ANNOUNCES KEY ACTIVITIES IN ADVANCE OF APRIL EARNINGS RELEASE

AstroNova, a global leader in data visualization technologies, has successfully secured an amendment and waiver for its revolving credit facility and term loans with Bank of America. The Company also announced preliminary, unaudited financial results for its fiscal 2025 fourth quarter ended January 31, 2025, and introduced a restructuring plan aimed at generating $3 million in annualized cost savings.

Credit Agreement Amendment and Waiver

AstroNova has obtained a waiver and amendment to its credit agreement with Bank of America. Key provisions include:

- Waiver of certain covenants for the fiscal quarter ended January 31, 2025.

- Relaxed financial covenant ratios for fiscal 2026.

- Reduced term loan payments for fiscal 2026 to support restructuring efforts, with increased payments following implementation.

- Up to $2 million in add-backs to Consolidated Adjusted EBITDA for cash restructuring charges in fiscal 2026.

Preliminary Q4 FY 2025 Financial Results

For the three months ended January 31, 2025, AstroNova reports unaudited revenue of $37.4 million, compared to $39.6 million in the prior-year quarter. Key factors influencing results:

- Lower sales of large Trojan Label printers and obsoleted products in the Product Identification (PI) segment.

- Timing of defense orders: Two large defense contracts fulfilled in Q4 FY 2024 are expected to reoccur in the first half of FY 2026.

- Delayed order ramp-up post-Boeing strike.

- $13.4 million goodwill impairment charge related to the PI segment, primarily linked to the Company’s MTEX business.

The Q4 FY 2025 audit is still in progress. Final results for Q4 and full-year FY 2025 will be reported on April 14, 2025.

Fiscal 2026 Guidance

AstroNova projects:

- Revenue: $160 million – $165 million.

- Adjusted EBITDA margin: 8.5% – 9.5%.

Further improvements are expected beyond FY 2026 due to strategic initiatives and restructuring efforts.

Restructuring Plan

The restructuring plan includes:

- Global workforce reduction by 10%, mainly in the PI segment.

- MTEX operation realignment in Portugal.

- 70% reduction in MTEX product portfolio, eliminating low-volume, low-profit models.

- Integration of MTEX sales, marketing, and customer support into AstroNova’s global teams.

Key Strategic Initiatives

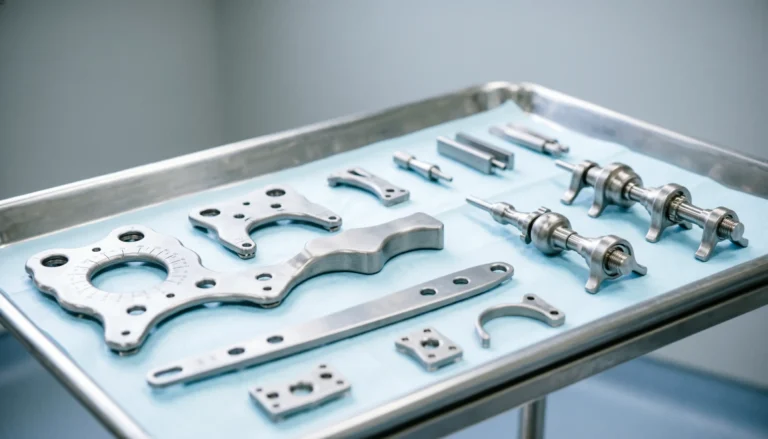

- Print Engine Technology Advancements

- Leveraging MTEX technology to develop next-generation print engines.

- Broadening application ranges and reducing customers’ total cost of ownership.

- Greater Control Over Consumables

- Strengthening supply chain oversight to improve margins.

- Product Line Optimization

- Converting legacy Aerospace printers to ToughWriter models.

- Streamlining the MTEX and legacy product portfolio.

- Organizational Enhancements

- Optimizing leadership roles to enhance accountability and segment-level reporting.

Management Commentary

“The restructuring and reorganization initiatives we announced today are designed to enhance profitability by aggressively cutting costs and streamlining operations,” said Greg Woods, President & CEO of AstroNova. “These actions will position us for margin expansion and accelerated growth in our core markets as we leverage the AstroNova Operating System, our established global customer relationships, and our strong brand recognition. We are particularly excited about the opportunities presented by our next-generation print engine technology, developed through the combined expertise of our AstroNova and MTEX engineering teams.”

Use of Non-GAAP Financial Measures

This release includes the non-GAAP financial measure Adjusted EBITDA margin, defined as GAAP net income (loss) adjusted for:

- Depreciation, amortization, interest, income taxes.

- Stock-based compensation, acquisition expenses, inventory step-up.

- Restructuring charges and asset impairment charges.

AstroNova believes this metric provides meaningful insights into core operating results. The Company is unable to reconcile forward-looking Adjusted EBITDA margin guidance to a GAAP measure due to the variability of certain GAAP components, such as compensation and amortization.

About AstroNova AstroNova (Nasdaq: ALOT) designs, manufactures, and markets data visualization technologies, including specialty printers and data acquisition systems. The Company serves aerospace, defense, industrial, and consumer goods markets worldwide.

Forward-Looking Statements This release includes forward-looking statements subject to risks and uncertainties. Actual results may differ due to various factors, including market conditions, operational execution, and strategic decisions. The Company disclaims any obligation to update forward-looking statements except as required by law.