AeroVironment Announces Pricing of Upsized Public Offerings, Targeting $1.47 Billion in Gross Proceeds

AeroVironment, Inc. (NASDAQ: AVAV), a leading provider of intelligent, multi-domain robotic systems for defense and commercial applications, has officially announced the pricing of its significantly upsized underwritten public offerings. The offerings include both common stock and convertible senior notes, and together they are expected to raise approximately $1.47 billion in net proceeds for the company. The capital infusion is aimed at supporting AeroVironment’s strategic objectives, including reducing outstanding debt and expanding its manufacturing capacity to meet increasing global demand.

Details of the Upsized Offerings

The company revealed that it will offer a total of 3,528,226 shares of its common stock at a public offering price of $248.00 per share. This represents a substantial upsizing from the company’s initial plans, reflecting strong investor interest and market confidence in AeroVironment’s long-term growth strategy. This common stock offering (the “Common Stock Offering”) is expected to raise a significant portion of the total proceeds.

Simultaneously, the company has launched an upsized underwritten public offering of its convertible senior notes, due in 2030. The offering totals $650 million in aggregate principal amount and carries a 0% interest rate (the “Convertible Notes Offering”). The decision to issue zero-coupon notes indicates AeroVironment’s intention to minimize cash interest expense while giving investors the potential upside of future equity conversion.

Anticipated Net Proceeds and Use of Funds

After accounting for underwriting discounts and commissions, as well as estimated offering expenses, AeroVironment expects to net approximately $1.47 billion in combined proceeds from the two offerings. This substantial capital inflow will be strategically deployed to strengthen the company’s financial position.

Specifically, the company intends to use approximately $965.3 million of the net proceeds to pay down existing debt obligations. These include repayment of outstanding indebtedness under its term loan and revolving credit facility. Reducing this debt burden is expected to improve AeroVironment’s balance sheet flexibility, lower its leverage ratios, and enhance overall financial health.

The remaining funds will be directed toward general corporate purposes. A key focus area includes investment in expanding manufacturing capabilities. As AeroVironment experiences increasing demand for its high-tech defense and robotic systems, especially in global geopolitical contexts emphasizing drone and autonomous technologies, increasing production capacity is vital for timely deliveries and customer satisfaction.

Underwriters’ Options for Additional Purchases

To accommodate possible over-allotments, AeroVironment has granted the underwriters a 30-day option to purchase up to an additional 529,234 shares of common stock at the public offering price, less underwriting discounts. In addition, underwriters have also been granted a 30-day option to purchase up to an additional $97.5 million aggregate principal amount of the convertible notes under similar terms. These options, if exercised, would further increase the total proceeds available to AeroVironment, potentially pushing net proceeds well beyond the current $1.47 billion estimate.

Convertible Notes Offering: Terms and Conversion Features

The convertible senior notes offered in this round are due in 2030 and do not bear interest, making them attractive for the company as a non-dilutive source of capital — unless converted. These notes may be converted at the option of the holders under specific circumstances and during certain periods.

The initial conversion rate is set at 3.1017 shares of common stock per $1,000 principal amount of notes. This corresponds to an initial conversion price of approximately $322.40 per share, which represents a 30% premium over the offering price of the common stock ($248.00 per share). This premium reflects optimism in AeroVironment’s future valuation and provides a potential upside for noteholders, while also minimizing immediate shareholder dilution.

At the time of conversion, AeroVironment may settle the notes in cash, shares of common stock, or a combination of both, at its discretion. This flexibility allows the company to manage dilution and cash outflow effectively, depending on prevailing market conditions at the time of conversion.

Timing and Closing Conditions

Both the Common Stock Offering and the Convertible Notes Offering are expected to close on July 3, 2025. However, each offering is subject to customary closing conditions, including regulatory approvals and final documentation. Importantly, the completion of one offering is not contingent on the closing of the other, meaning each transaction stands on its own merit and can proceed independently if required.

Leading Underwriters and Bookrunning Managers

AeroVironment has enlisted an experienced syndicate of financial institutions to manage the offerings. J.P. Morgan and BofA Securities are acting as lead book-running managers and representatives for the underwriters in both offerings. Their deep market expertise and institutional reach are critical to the success of this large-scale capital raise.

Additional joint book-running managers include Raymond James, RBC Capital Markets, William Blair, Baird, and BNP Paribas — each of which brings specialized experience and investor relationships to the table. For the Common Stock Offering, BTIG, Citizens Capital Markets, and BMO Capital Markets are participating as co-managers. These same three firms are also co-managing the Convertible Notes Offering, with U.S. Bancorp joining them for the latter.

This diverse and well-capitalized group of underwriters highlights the strong institutional demand and widespread interest in AeroVironment’s equity and debt securities. It also reinforces the credibility of the offerings in the eyes of both retail and institutional investors.

Regulatory Compliance and SEC Filings

To comply with securities regulations, AeroVironment has filed a registration statement, including a base prospectus, with the U.S. Securities and Exchange Commission (SEC). Preliminary prospectus supplements specific to both the Common Stock Offering and the Convertible Notes Offering have also been submitted. These documents contain critical information about the offerings, including terms, risks, and financial details.

Investors are strongly encouraged to review these filings before making any investment decisions. The prospectuses and registration statements can be accessed through the SEC’s EDGAR database at www.sec.gov.

In addition, interested parties can obtain copies of the preliminary prospectus supplements and accompanying prospectuses by contacting the underwriters directly. J.P. Morgan Securities LLC has designated Broadridge Financial Solutions as its distribution agent, reachable at 1155 Long Island Avenue, Edgewood, NY 11717, or via email at prospectus-eq_fi@jpmchase.com and postsalemanualrequests@broadridge.com. Similarly, BofA Securities has made its prospectus department available via email at dg.prospectus_requests@bofa.com or through its Charlotte, NC office.

Legal Disclaimers

As a standard legal disclaimer, AeroVironment emphasized that this announcement does not constitute an offer to sell or a solicitation of an offer to buy any securities, including the shares of common stock, the convertible notes, or any common stock issuable upon conversion of the notes. Any offer or sale will only be made through official prospectus documents filed with and approved by the SEC, and only in jurisdictions where such transactions are legally permitted under local securities laws.

Strategic Context and Future Outlook

AeroVironment’s decision to conduct simultaneous public offerings of common stock and convertible notes is a strategic maneuver designed to optimize capital structure, support operational growth, and enhance the company’s agility in a rapidly evolving defense technology environment.

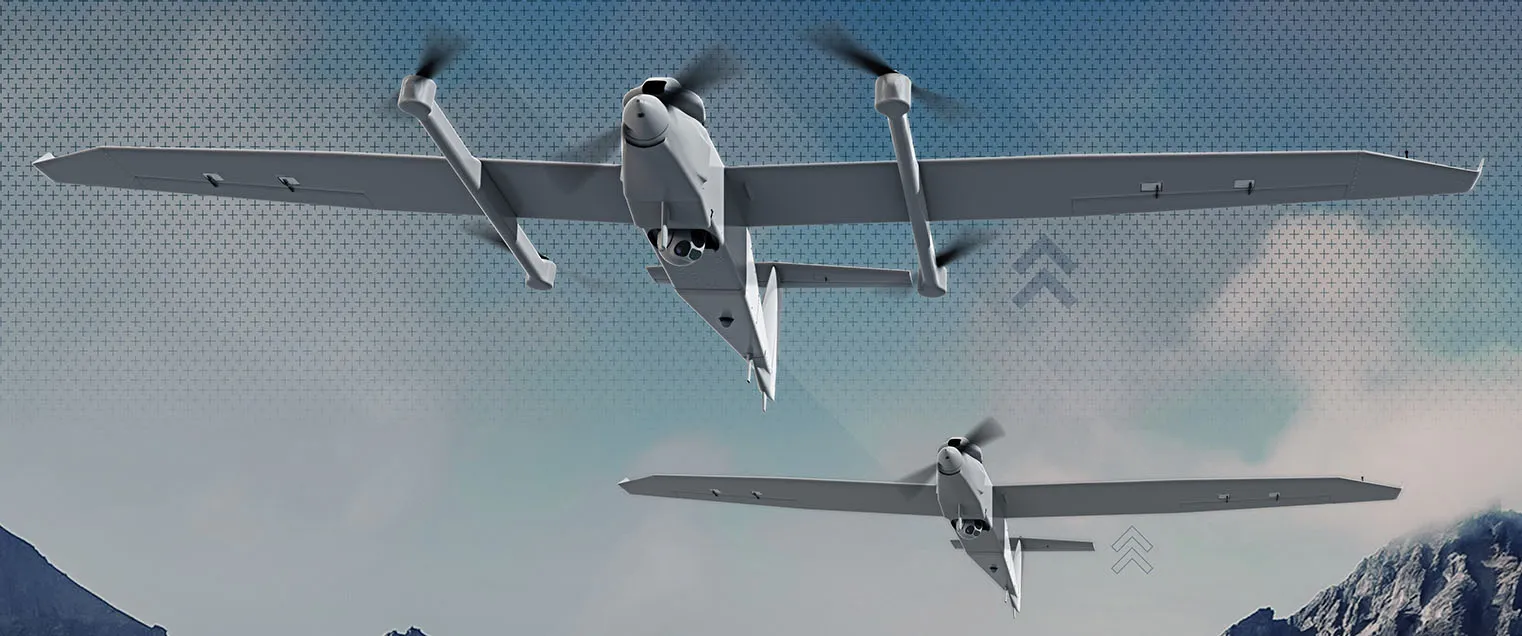

The move comes at a time when demand for advanced drone systems, autonomous vehicles, and AI-powered surveillance technology is increasing significantly across defense and homeland security sectors. As a recognized leader in these domains, AeroVironment is well-positioned to capture a larger share of this expanding market — provided it can scale its operations to meet the surge in demand.

By retiring debt and investing in manufacturing expansion, AeroVironment is laying the groundwork for sustainable long-term growth. Moreover, with zero-coupon notes and a relatively low equity dilution, the financing structure preserves shareholder value while ensuring the company remains financially robust and competitive.

In summary, AeroVironment’s successful pricing of its upsized common stock and convertible note offerings represents a milestone financial event. The combined $1.47 billion in expected net proceeds will empower the company to accelerate its strategic growth initiatives, improve its financial foundation, and maintain its leadership in advanced unmanned systems and defense technologies. With strong institutional backing and investor confidence, AeroVironment appears well-prepared to navigate the future with enhanced capabilities, agility, and resilience.